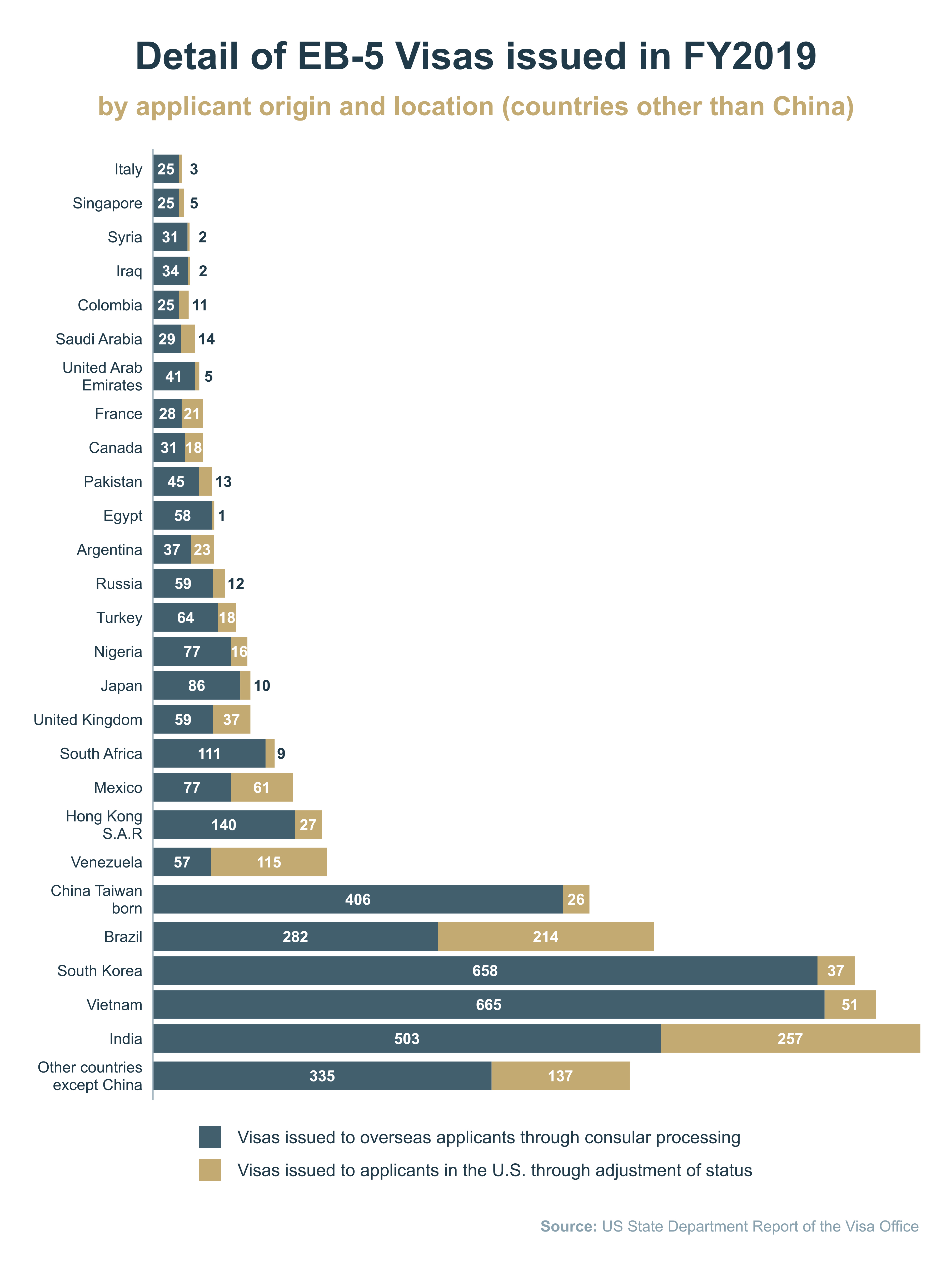

People from all countries have access to an immigrant visa, known as the EB5 Visa. Foreign applicants and their family members, including their spouses and unmarried children under 21, can apply for the EB5 visa, which grants them permanent resident status in the U.S.

The primary requirement for an EB5 visa is for the foreign investor to make a minimum investment in a new business commercial enterprise. The minimum required investment is $800,000.

Qualified immigrant investors of the EB5 visa allow the family to obtain a green card, becoming permanent legal residents by investing in a new business. The investor must provide sufficient investment capital to start up a United States enterprise that can sustain a minimum of 10 workers who will have full-time employment. By investing, the foreign investor, their spouse, and qualifying children can live and work freely within the United States. Children of the investor qualify for the same employment and educational opportunities as every other US resident. No licenses are required when applying for an EB5 visa.

Source: https://eb5visainvestments.com/2020/03/07/fy2019-eb-5-country-stats1709…

Requirements For EB5 Visa Investment

There are three EB5 visa requirements for investing:

- Minimum investment amount

- Source of investment funds

- Job creation

EB5 Minimum Investment Amount

The EB5 Minimum Investment Amount is the core investment required from immigrant investors to qualify for the EB5 Visa. The lowest investment capital is $800,000 if the commercial enterprise is established in a Targeted Employment Area (TEA). A Targeted Employment Area can be located in rural areas or an area that has a high unemployment rate specifically 150% of the national average. If a foreign investor does not start a new commercial enterprise in a TEA, the required investment capital is $1.05 million.

The investment should be for a new commercial entity that has been approved by United States Citizenship and Immigration Services (USCIS). The money invested should be considered “at-risk,” as there is no guarantee of an investment return for the investor.

Source of Investment Funds and Funding Requirements

When discussing the source of investment funds, there are a variety of approved investment sources the funds can come from. They can be business profits, wages and salaries from employment, loan, gifts from individuals, or an inheritance. The EB5 immigrant investor is required to prove the legality of the source of funds used for an EB5 investment using all required documents.

Business Profits

Business Profits

Business profits are the monetary funds that remain when an “at-risk” business exceeds the costs, expenses, and taxes of the company. To prove this source of funds, the investor must supply bank statements that show the transferring of money from a buyer into the business account, along with a copy of the deed of sale. Additionally, the funding requirements for allowing the use of business profits include business registration and proof of officership or ownership.

Wages and Salaries From Employment

Wages and Salaries From Employment

Wages and salaries are income generated from employment. Wages and salaries include bonuses, overtime pay, annuities, allowances, and bonuses. To prove employment earnings, the investor must submit multiple year’s worth of tax returns, accompanied by a letter from the employer listing salary, pay slips, and work responsibilities.

Loans From a Bank, Financial Institution, or Individual

Loans From a Bank, Financial Institution, or Individual

A loan, no matter its source, is a type of debt that an entity or an individual incurs. The loan is required to be secured by assets other than those involved with the EB5 Corporation. To prove the legality of a loan, you must submit tax returns, tax declarations, or other pertinent documents.

Gifts From Individuals

Gifts From Individuals

A gift is given without expectation of repayment and is strictly voluntary. The investor must submit a signed document from the giver stating that the beneficiary of the gift is not expected to repay the funds. In addition, there should be supporting documentation showing the original acquisition of the funds of the giver, letters verifying employment, the giver’s in-depth background information, and the giver’s résumé.

Inheritance

Inheritance

An inheritance is assets transferred from a deceased person to a receiver. Inheritances can come from investments, cash, jewelry, art, and real estate. An investor must show the connection or relationship between the two parties if the inheritance was received before the start of the EB5 application. The investor can approve this by submitting the will, probate court documents, bank statements, and other relevant proof substantiating the inheritance's legitimacy.

EB5 Job Creation and Employment Requirements

The EB5 job creation and employment requirements include creating, at minimum, ten full-time employment positions for qualified American workers. These ten full-time positions must be created within two years of the investor receiving a conditional residency. To qualify as an employee, the workers must be lawful permanent residents, U.S. citizens with permanent residence, or other immigrants who are lawfully allowed to gain employment in the U.S., such as asylees, refugees, and conditional residents. A full-time employment position for US workers must have at least 35 working hours each week.

Job creation from an EB5 investment can be direct, induced, or indirect jobs. These jobs can be created from direct investment or through a regional center.

Direct jobs stem from direct EB5 investment. Direct investment is a substantial investment into a new commercial enterprise created from the investment money of a foreign investor who is not sponsored by a regional center. Direct investment can include:

- Investing in an existing corporation

- Starting a new business

- Opening a franchise

- Purchasing an existing for-profit business (as long as it is not a troubled business)

EB5 Regional Centers create indirect jobs and induced jobs. A Regional Center is a private or public economic unit approved by the USCIS to promote U.S. economic growth. Indirect job creation comes from outside the new commercial enterprise but has resulted from the operations of the new commercial enterprise. An example of this would be jobs created that make supplies for the investor’s business, such as construction equipment.

Induced jobs result from the creation of the investment made from the regional center in a community. Induced jobs result from increased spending in local businesses because they promote economic growth where the new EB5 project has been created. This is especially true in a rural area.

Documents Required For EB5 Visa Application

Investors seeking to become green card holders with permanent residency are required to submit the following project, financial, and personal documents:

Project Documentation

- Evidence of the investment in a qualifying EB5 project

- Proof of location within a targeted employment area (TEA)

- Evidence stating the investment is going towards a new business

- The Private Placement Memorandum (PPM) for a regional center investment

- Copies of the LLC Agreement, Subscription Agreement, and Escrow Agreement for the commercial entity

- A comprehensive business plan that contains:

- Required permits or licenses

- Complete business analysis, including an economic growth plan

- Contracts

- The production process

- Organizational structure

- Marketing strategy

Financial Documentation

- Proof of the funding source, which must include the complete history of the funds. The funding can come from salary, savings, property sales, gifts, or other assets

- Tax returns for no less than the previous five years

- Proof that the cash equivalents (from loans) being used by the investor were obtained legally

Personal Documentation

- Photocopies of the investor, spouse, and any dependent’s passports

- Certificates of marriage and birth for the investor and all family members

- National or local identity documents

- Photocopies of current and previously filed immigration applications